How to Support Employees with a Holistic Financial Wellness Program

Is There Really a Need?

The importance of creating an inclusive culture is vital to designing a workplace where all employees can flourish and do their best work - resulting in ideal business outcomes. Companies that care about employee comprehensive wellness and support them in multiple areas of their lives, are places which draw and retain the best people.

What is a Holistic Financial Wellness Program?

Financial wellness is the ability of a person to precisely check their present financial position, identify personal goals, and be motivated to achieve the knowledge, support and resources to create behavioral change.

Money impacts all areas of our lives: health, faith, relationships, career, etc. Make sure your wellness program does more than financial investments. Going deeper impacts the root cause of issues and the driving force for transformation... the habits, behaviors and mindsets... not the symptoms like a budgeting form or meeting with an adviser to invest more.

A holistic financial wellness program will result in better physical, emotional and mental well-being as well as financial stability. Bottom line, you are helping them become a better employee while positively impacting their lives.

High Financial Stress

Health education and wellness programs have long been offered in the workplace. Employers are increasingly adding a financial wellness component to their total benefit program due to the measurable impact it has on stress and productivity for their employees.

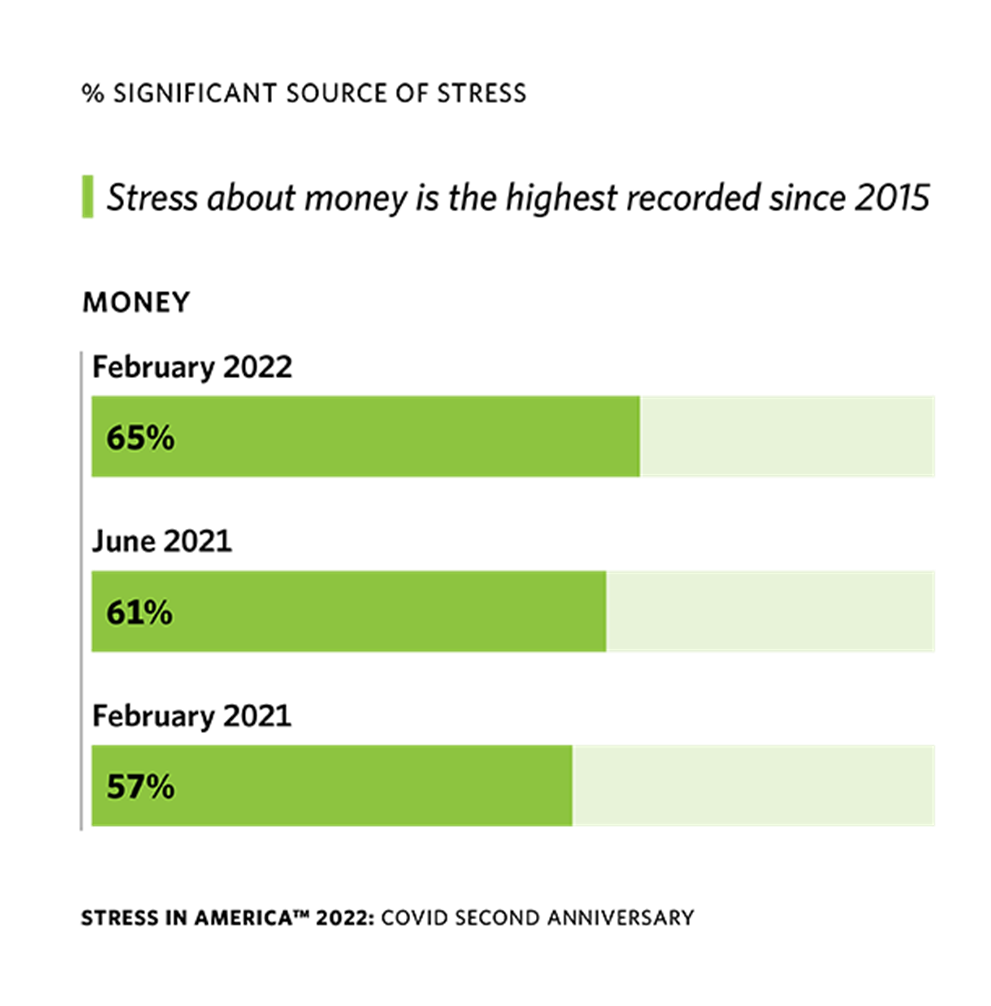

According to a study done by the American Psychological Association, the infographic below displays the percent of Americans, by month, who report money as a huge source of stress. This is the highest recorded since 2015.

The Impact of Financial Stress on Personnel (and Your Profits)

The responsibility of saving for retirement has moved from the employer to the employee because of the decrease in traditional pension plans and increased use of defined contribution plans. Workers must now carve out part of their paycheck to save for retirement, as well as stretch it to meet other things like student loans, medical payments and insurance. This increased battle for money only adds to their overall financial stress.

Among employees who say that their financial worries have had a severe or major negative impact on their productivity at work, 67% are struggling to meet their household expenses on time each month, 71% have personal debt and 64% are using credit cards to pay for necessities they couldn’t otherwise afford. One in four have saved less than $1,000 for retirement, and more than half plan to postpone their retirement. (Employee Financial Wellness Survey, 2022)

40% of workers say they would be more productive if they didn’t worry about their personal finances at work. Additionally, 26% of workers said they spend three or more hours per month on their finances while at work. (Hancock, 2021)

Increased absenteeism, lost productivity and mental uncertainty result in high costs to employers. Offering a financial wellness program can reduce stress and transform their employee’s lives while helping your bottom line.

In the same study 89% of workers surveyed feel it’s important for employers to make a financial wellness program available. Additionally,

- 74% say financial wellness programs help reduce financial stress

- 57% say financial wellness programs increase their productivity

- 66% say financial wellness programs improve their company loyalty

These feelings cause positive results in recruitment, retention and engagement. The right financial wellness program can help mitigate the high costs of losing employees (recruiting, loss of institutional knowledge and training). Imagine your employees becoming your best recruiters as well as making improved benefit decisions.

What’s Important in Planning a Financial Wellness Program?

- Provide quality financial wellness to employees focusing on:

- Tactical tools to address immediate financial concerns.

- Strategic mindset to address aspirational goals.

- Individualized guidance to facilitate the creation of a plan.

- Accountability to follow through.

- Personalization

- Relevant.

- Employees feel valued.

- Create the biggest transformations.

- Grow a sense of safety and security.

- Prepared to work with other professionals (Financial Advisors, Realtors)

Helping You Get There

The best employers to work for are those who genuinely care about their employees beyond the workplace. Making an impact by providing the education and support they need to gain control of their finances is making a positive impact for your people and your business.

Most business owners and HR departments don't have extra time to implement a financial wellness program while running a successful business. Using us, you can spend your time doing what you do best & trust us to do what we do best.

Your employees deserve more than a generic lunch and learn budgeting workshop or annual visit with an adviser to discuss 401(k) allocations. We provide a custom package of group, 1-on-1, in-person and web coaching as well as online tools & courses to match their financial situation. Financial Accountability Coach™ professionals offer the personal touch to help you make your employees feel valued, amplify transformation and provide accountability while creating a path to financial success.

Since our financial wellness programs can be completely customized to your organization's needs, the needs of your employees, and the scope of the project, we always begin by offering a free, no-obligation design consultation.

Our design consultation is formulated to help us learn all about your organization’s needs, goals, and background – so we can connect your employees with the specific resources they need to start thriving.

This process ends in a proposal so that you will know exactly what you are receiving, and the financial investment involved before deciding whether you’d like to partner with us.

Book a free Design Consultation!

References

- Infographic: Stress about money and economy is on the rise

- Financial Stress Survey - John Hancock

- Financial Wellness Programs Promote a Thriving Workforce

- The Case For Employee Wellness Program Benefits

- Evaluating the VOI of employee health benefits.

- 2022 PwC Employee Financial Wellness Survey

-------------------------------------------------------------------

About the Author

Parents are stressed because their money is stretched thin and retirement savings are sparse or not there at all. Ron and Meg Knapper know how that feels. They felt embarrassed, even with Ron’s MBA and Meg’s M. Ed. that they didn’t have control of their money. It was frustrating having money slip through their fingers.

Ron and Meg are passionate about helping other couples avoid the struggle they experienced and instead enjoy the security and confidence they have found. They have both completed coach training and started Knapper Financial Coaching in 2017 to help parents find, keep, and grow their money.

Coaching as a couple provides the strongest opportunity for their clients to be seen, heard, and understood through 1-on-1 coaching, speaking, and workshops. Ron and Meg continue to sharpen their coaching skills by participating and serving in leadership roles with Coach Connections™ and the Accountable Network.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.