10 Money Must-Knows for a Happy Marriage: Are You Prepared?

So, you're getting hitched! You're making what you hope will be a lifelong commitment to the one you love through sickness and health, for richer or poorer, now and until death do you part. Sounds heavy? Well, it is! And the best way to make it less heavy is by getting the leading cause for marital splits out of the picture: money fights.

Financial disagreements are among the top 3 causes for divorce, along with infidelity and basic incompatibility. That's why it's crucial to get started on the right foot by addressing any potential money issues upfront, discussing short and long-term goals as a couple, and having open and intentional conversations about money. By doing so, you can avoid unnecessary stress and focus on building a strong and lasting partnership.

Before we go further, bear in mind that money is a very sensitive topic for some people. Why? Because it's personal, and it's based on what you've been taught by people you respect and trust, like your parents. There are two main ways in which most people learn about money: what they hear or are told, and what they feel and observe. If you didn't have role models to teach you about money growing up, you have to figure it out on your own, through trial and error. This can lead to many painful lessons in the form of fees, fines, and penalties. These can cause shame, guilt and remorse. It’s not your fault, but as my dad would say, "Smart people learn from their mistakes, and really smart people learn from other people's mistakes."

So without further ado, here are 10 things about money you should discuss with your partner before you tie the knot:

- Joint bank accounts: One of the main ideas of marriage is two become one… two lives, becoming one through, yes you know, sickness and health, richer or poorer etc. I have heard a ton on this topic. Listen, whether you combine accounts or keep them separate, it's critical to have a healthy financial communication system between the two of you. In general, joining bank accounts makes it much easier to track shared expenses and communicate clearly. The less moving parts, the easier it is to track, communicate and everyone is on the same page. This comes down to trust and communication.

- Open Communication: Successful partners openly communicate about money on a regular basis, either daily, weekly, or at least monthly. They discuss concerns, goals, dreams, fears, all of it. Take time to sit down and talk to your partner about your goals and dreams as a couple. What, where, when, how -- don't hold back. Also, be honest about what you were or were not taught about money growing up. For more tips on improving money conversations, check out Improving Money Communication with Your Spouse.

- Show all your cards: Be honest about debt. Show everything -- student loans, credit cards, auto loans, medical debt, tax debts, 401(k) loans, and that loan from Uncle John for the business venture. Talk to each other about how you can become debt-free together.

- Lifestyle choices: I’m not talking about the decision to join a sorority or spring break in Cancun. I am talking about everyday lifestyle. Tory Burch vs. Vans Prada vs. Kohl's. Charities that are important, hunting season, annual ski trips, you get the point. These things don't change much even after you get married, and it's good to be upfront about expectations, non-negotiable things and spending habits.

- Personality differences: Everyone is unique and brings something to the table. There are some qualities you love about the other person and others you don’t quite understand. I chose my wife for the wonderful things she possesses that make me a better person. Things I strive to be myself, look at in bewilderment, and frankly could never see myself doing. We both have these qualities, when put together we are stronger as a whole.

I, for example, am spontaneous and very outgoing. I am very comfortable talking with strangers. I’ve been known to strike conversations up in an elevator. Not only that, but I love Halloween because you can use your imagination, get creative and live out your ideas once a year for all to see. My wife, on the other hand, not so much. She is more reserved, isn't very talkative around new people, not shy but more comfortable with the other person initiating conversation. Once she gets to know you and likes you, she opens up and lets you in, where I am an open book from the start. She doesn't like spur of the moment ideas. She likes things to have an itinerary of sorts. Likewise, she tends to plan things out. I, on the other hand, will go with the flow and figure it out as we go. Now admitting it's not always the best plan of action, but some great stories have come from this approach as you can imagine. These qualities have come in handy on both ends for both of us.

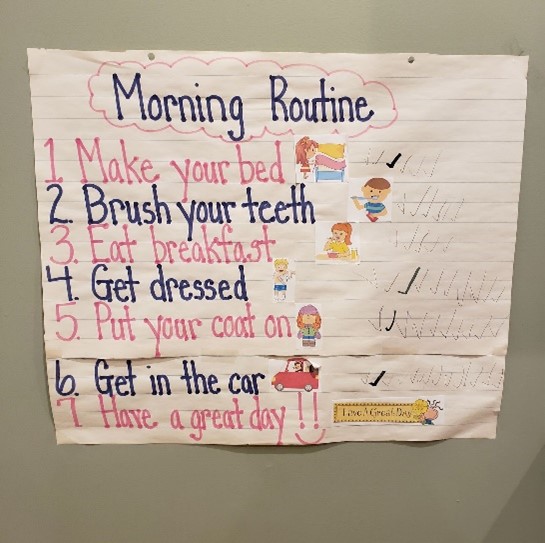

Once we had children, having someone lay out the morning routine step by step and post it on our kitchen wall brought the level of shall we say chaos to minimum levels. She saw the issue clear as day and brought her strong quality to rescue. Now, I needed to conform and participate for this to work. Like I said, it's not my nature, it took a few weeks to get it working like a well-oiled machine.

There have been times when having me be the icebreaker at events and conversation starter has been invaluable. They have led to great fun, memorable evenings and new friends.

Many people stick with what works, and live within their comfort zone. They need an itinerary to know what's next. Some people don't like too many rules, they aren't very organized and are spontaneous at heart. They are perfectly fine with winging it.

How does this tie into money? Budgets aren’t everyone's favorite, one person might say it’s not their thing or too restrictive. Let’s put it this way – chances are the person doing all the wedding planning right now, that's the planner they may be tilted towards budgeting numbers and the other person is the one that says, "Sure babe, whatever you want sounds good!" or “yeah we’ll just figure it out.” This might not be the case because everyone's different. Believe it or not, my wife doesn’t like sitting down and reviewing the monthly budget…what I know, right!! But we both know we need to do things for each other to make things work in the long run. It’s about balancing each other out to make the team stronger. It's also about participating in the process.

Remember I said open communication is important for a successful marriage? Well, part of that is the dreaded "B" word, Budgeting. Since I hate that word, let's say cash flow planning meetings. It helps to tell your money where to go, versus wondering where it went. That means sitting down together at a designated time and having the wildcard show up and contribute to the meeting in some way and participate. I like them changing one thing in the spending plan, adding something, so they have some ownership in the process. You're a team, and you're in this together.

- Salary differences: Whoever earns more money doesn't automatically have a greater say in financial decisions. As a team, you both have equal say. Treat your budget meetings like you would a company: lay out your income and expenses. And think about how to best use this money to stay profitable, stay afloat and grow together.

- Keep purchases in the open: Financial infidelity is a real thing. Financial infidelity is not uncommon among couples, and it occurs in all age groups. A study found that 27% of the participants had kept a financial secret from their partner. This study was published by the American Psychological Association. This breaks down trust and causes all types of problems. It's not worth it. Believe me, the damage lasts way longer than the joy of whatever you buy secretly. It can also lead to divorce, which is the opposite of our goal here.

- Set expectations and boundaries: When it comes to money, being proactive and setting clear guidelines can go a long way in maintaining a healthy marriage. Work together to create a financial decision-making framework you both can stick to. Agree to discuss purchases that go over a specified amount or take a few days to research and think over significant financial decisions, like buying a car. If it involves an amount over your agreed upon specified amount, sleep on it. You want to make decisions based on facts, not emotions. Use cash when you're able to, discuss credit card spends, and be clear on your partner's expectations regarding things like family vacations and career paths.

- Children and Money: I’m not talking about the true cost of raising children, such as childcare, clothes, medicine, camp, diapers, etc. That's important to know, but before you get married, talk to your partner about what you want to teach your kids about money. What attitudes and money habits do you want your children to develop? Will they learn that "work equals money" or will they grow up thinking "I get money from my parents for breathing?" Will they learn delayed gratification? When they want a video game, will you give it to them instantly or teach them to wait and save up for it? Think about all the things you wish you'd learned about money when you were young. Talk to your partner about how you will pass these money lessons on to your kids.

- Money isn’t everything: Before I got married, I got wise counsel from a great friend and spiritual guide who told me what really matters in a successful marriage (hint: it’s not money!). He talked to me about firemen and here's what he said:

- Firemen know to take care of people over things in a fire, because things are replaceable.

- They communicate in scary situations. They know where everyone is, and what their teammates need most at all times during a fire.

- They always have each other's backs. The bond between firemen is fierce; they fight for each other and support each other unconditionally.

My friend told me that once I get married and start a new family, I’d have to be willing to stand up and fight for it. My old family, the one I came from, would have a lot of opinions on what I should and shouldn't do, but they're not my new family. Sometimes, you need to fight for what you believe is right and do what you need to, to take your new family in a new direction.

Remember, every household is unique. You may have other variables to consider for you and your spouse when it comes to creating healthy communication. If you need additional support, a second set of eyes or a referee, consider meeting with a Financial Accountability Coach™ who can help you assess your situation and find solutions that work for you.

Book a free coach match session!

I want to wish you all the blessings of a successful marriage, all the fruits of your hard work, and all the fun memories that come with growing old together. If you need help along your journey, please reach out to me through my website www.progressfc.com or via email at [email protected].

Additional Resources:

If you are looking for more expert tips to help you start your marriage on the right financial foot, check out our blog: How Can Newlyweds Build Wealth and Achieve Financial Success with Expert Tips?

-------------------------------------------------------------------

About the Author

Connor Tyson (Owner/ Founder of Progress Solutions)

Hi, I’m Connor, I help people going through life transitions who feel they aren't where they should be in their personal finances, feel unsure or uneasy about their current situation get unstuck from their current situation by providing a simple and proven path forward, so they can move forward with confidence and change the trajectory of their financial futures and that of their families.

- BS degree - Finance, from Quinnipiac University, 1999

- Financial Advisor for over 20 years, Series 65, Registered Investment Advisor

- ChFC ® designation - Chartered Financial Consultant

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.